25-26 February 2025

Johannesburg, South Africa

Our Fifth Africa Family Office Investment Summit has been designed specifically for family offices in the region, and those who want to connect with them.

Introduction

As we continue to build our family office network in Africa, our fifth Africa Family Office Investment Summit is set to be the best yet.

This rapidly growing event brings together family offices from all over Africa, while offering the opportunity for service providers to meet and mingle with them.

Thanks to Alea’s own status as a family office, with a well established network of events around the world, our summits attract family office members themselves rather than their nominated representatives. This carefully targeted guestlist, plus our relaxed networking environment, makes this the perfect setting for service providers to meet family office decision-makers.

A curated program of panels, talks and pitches is informed by the concerns of family offices in the region specifically. As well as having a region-specific focus, we take care to include universal family office topics such as real estate and succession planning. We also offer service providers the chance to shape the content around their own areas of expertise.

Our story

The Alduaij family office has a long and illustrious history in Kuwait as one of the most prominent and respected business forces in the region, as well as one of the most socially responsible.

Through their networks, Alea Global have formed strong personal and professional relationships with other family offices across the globe, all sharing much common ground and a willingness to work together.

From this network, experience and expertise, a series of successful Family Office Investment Summits has arisen, attended by ruling and elite families from every region with an historic and enduring influence on the global economy.

Our fourth Africa Family Office Investment Summit is the latest of these, building on the success of other such summits around the world.

As a family office ourselves – as well as your conference host – we understand the needs, concerns and wishes of family businesses better than anyone else.

We share many of your experiences and objectives, and we understand what makes an event like this beneficial to family offices as well as service providers.

Previous Speakers

Agenda

15:00 Registration

Registration, Networking and one-on-one meetings.

16:00 Welcome

Welcome and opening remarks.

16:05 Bringing the world to Africa: what works, and what doesn’t

- How African nations can simplify business registration, licensing, and taxation to attract more foreign direct investment (FDI).

- Strengthening investor protection laws and intellectual property rights to build confidence in African markets.

- Examining tax breaks, free trade zones, and sector-specific incentives offered by African governments to draw in foreign capital.

- Leveraging the African Continental Free Trade Area (AfCFTA) and regional agreements to create a more integrated and investor-friendly environment.

16:45 Safeguarding African families’ wealth

- Best practices for establishing family offices that manage diverse asset portfolios across African and global markets.

- Ensuring smooth leadership transitions by creating robust governance structures and preparing the next generation of leaders.

- Navigating Africa’s complex tax environments and legal frameworks to optimize wealth preservation and transfer strategies.

- Integrating values-driven strategies like philanthropy and impact investing into family office planning to leave a lasting legacy.

17:15 Roundtable Discussions

With peer learning and interaction in mind, these 60- minute breakout sessions are designed to promote the sharing of experiences and brainstorming of ideas in facilitated and balanced discussions.

18:15 Networking Break

Evening networking coffee break.

18:45 Strategic investments in Africa’s natural resources

- Tapping into Africa’s abundant gold and oil reserves to meet rising global demand and boost local economies.

- Managing risks and seizing opportunities in the face of fluctuating oil prices and gold market dynamics.

- Understanding regulatory frameworks, government policies, and local content requirements shaping the investment landscape.

- Exploring ESG-compliant strategies for minimizing environmental impact while maximizing profitability in gold mining and oil extraction.

19:20 Profits and sustainability can be friends: here’s how

- Leveraging Africa’s fertile land and diverse climates to invest in scalable agriculture ventures that address food security and export markets.

- Exploring water management technologies and irrigation solutions to overcome water shortages and boost agricultural productivity.

- Investing in sustainable farming practices and drought-resistant crops to mitigate the impact of climate change on food production.

- Collaborating with governments, local farmers, and private investors to develop infrastructure, ensure efficient water use, and enhance value chains.

20:00 Networking Dinner

A chance to network in an informal setting and discuss the day’s events over dinner.

08:30 Registration

Registration, Networking and one-on-one meetings

09:30 Welcome

Welcome and opening remarks.

09:45 Presentation: Economic Overview

10:00 A new era for Africa: 2025 and beyond

- Harnessing the power of Africa’s young, tech-savvy population to drive growth in sectors like fintech, agritech, and e-commerce.

- Maximizing the potential of the African Continental Free Trade Area (AfCFTA) to boost intra-African trade and attract global investment.

- Investing in critical infrastructure projects—energy, transport, and technology—to support urbanization and rural development.

- Leading the global charge in green energy investments and climate-smart agriculture to position Africa as a sustainable growth hub.

10:40 Riding the wave of private equity and startup investments in Africa

- Balancing traditional investments with high-growth opportunities in private equity, venture capital, and African startups.

- Exploring how private equity investments in infrastructure, healthcare, and technology can generate strong returns while driving economic growth.

- Tapping into Africa’s rapidly evolving startup scene, with a focus on sectors like fintech, agritech, and e-commerce.

- Structuring portfolios that minimize risk while taking advantage of Africa’s emerging market potential for long-term wealth generation.

11:10 Networking Break

Morning networking coffee break.

11:30 Can real estate keep up with Africa?

- Capitalizing on rapid population growth via housing, infrastructure, and commercial real estate.

- Integrating eco-friendly practices into real estate investments for long-term value and compliance with ESG standards.

- Exploring opportunities in affordable housing projects to address the housing deficit while driving economic development.

- Leveraging government incentives and private sector expertise to build critical infrastructure and foster inclusive growth in key urban areas.

12:15 Presentation: Digital Payment

12:30 The next big thing

Our pick of the best investment opportunities for the next 6 months.

13:00 Networking Lunch

A chance to meet and discuss the morning’s sessions over lunch.

14:15 Key opportunities in the blooming friendship between the Gulf and Africa

- Exploring key sectors for collaboration, including infrastructure, energy, and agriculture, to drive mutual economic growth.

- Identifying emerging opportunities in trade, logistics, and capital flows between the Gulf and Africa.

- Leveraging Sharia-compliant financial products to unlock capital for large-scale projects across Africa.

- Investing in transport, logistics, and communication networks to enhance trade and economic integration between the regions.

15:00 Presentation

15:45 A spotlight on Africa’s incoming economic trends

- Assessing Africa’s economic rebound, growth sectors, and lessons learned from navigating global disruptions.

- Exploring how digital transformation, fintech, and mobile technologies are driving economic growth across the continent.

- Tapping into Africa’s expanding middle class and increasing consumer demand in sectors like retail, entertainment, and financial services.

- Understanding macroeconomic challenges such as inflation, exchange rate volatility, and the impact of monetary policy on investment decisions.

16:15 Open Discussion: Plan for success with your succession plans

- Making the most of all available talent and enthusiasm within your family office

- Prioritizing personal development alongside professional development – how and why

- Success stories and cautionary tales to help inform your succession plans

16:50 Closing Remarks

Closing Remarks For the summit.

17:00 Cocktail Reception

A Cocktail reception with the chance to network in an informal setting and discuss the summit.

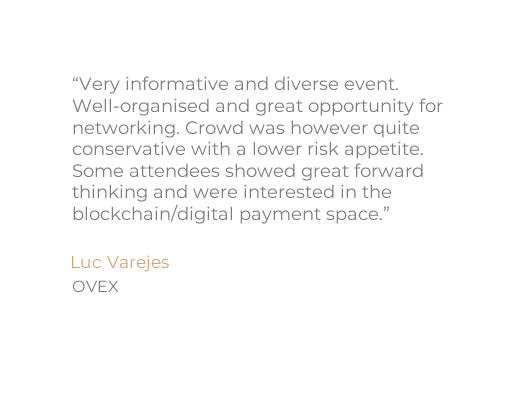

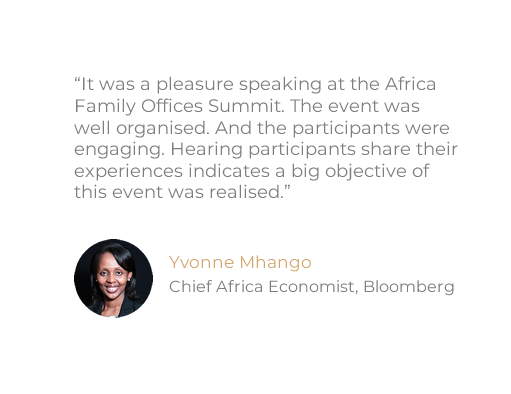

What Our Attendees Say

Sponsors

We are extremely grateful for the support of our sponsors, who help to make all this possible.

Get in touch

Email us at [email protected].

Please Note: Registration is subject to Advisory Board approval.

Terms and Conditions Apply.